Are you looking to up your betting game and maximize your returns? In the world of sports betting, leveraging multiple markets through cross-market betting can be a game-changer. By exploring various markets simultaneously, you can increase your chances of success and potentially boost your profits.

In this article, I’ll delve into the strategies and benefits of cross-market betting. Discover how you can take advantage of different markets to diversify your bets, hedge against risks, and capitalize on valuable opportunities.

Whether you’re a seasoned bettor or just starting out, understanding the ins and outs of cross-market betting can give you a competitive edge in the world of sports wagering.

Understanding Cross-Market Betting

Exploring the concept of cross-market betting is crucial in sports wagering. In this strategy, I aim to leverage multiple markets simultaneously to increase success rates and enhance profitability.

By diversifying bets across different markets, I can mitigate risks and capitalize on lucrative opportunities for a competitive edge. This approach allows me to optimize returns by spreading bets strategically and capitalizing on a broader spectrum of potential outcomes.

Benefits of Leveraging Multiple Markets

Cross-market betting offers significant advantages that can enhance betting strategies and boost returns. By leveraging multiple markets simultaneously, bettors can tap into a wealth of benefits that contribute to their overall success.

Increased Opportunities for Profit

- Diversifying Your Portfolio: Expanding your betting portfolio across various markets increases your chances of identifying undervalued odds and profitable outcomes. By diversifying, you can tap into different sectors, enhancing your overall betting strategy.

-

Maximizing Returns: A diversified approach allows you to explore a broader range of possibilities in the betting landscape, ultimately maximizing your potential returns. This strategy helps mitigate risks while taking advantage of favorable opportunities across multiple markets.

Risk Mitigation

One of the key benefits of leveraging multiple markets is the ability to mitigate risks effectively. By spreading your bets across different markets, you distribute the risk associated with individual bets.

This diversification strategy helps safeguard your investments by reducing the impact of losses in one market through gains in another. It’s a prudent risk management approach that can enhance your overall betting experience and financial stability.

Diversification of Portfolio

Diversifying your betting portfolio across multiple markets is akin to spreading your investments in financial markets to minimize risk. This strategy allows you to balance your betting exposure and create a more stable and resilient portfolio.

By diversifying, you can tap into various market dynamics, capitalize on different trends, and adapt to changing conditions more effectively. This proactive approach enhances your betting resilience and positions you to benefit from a more diverse range of outcomes.

Strategies for Cross-Market Betting

When it comes to cross-market betting, one of the key strategies to leverage is identifying arbitrage opportunities. Arbitrage occurs when a bettor can place wagers on all possible outcomes of an event across different markets, ensuring a profit regardless of the result.

By capitalizing on variations in odds between markets, I can strategically place bets to guarantee a positive return.

Value Betting

Another effective strategy for cross-market betting is value betting. This approach involves identifying bets where the probability of a particular outcome is higher than the implied probability reflected in the odds.

By conducting thorough research and analysis, I can pinpoint undervalued odds and capitalize on favorable betting opportunities to maximize my returns.

Hedge Betting

Hedge betting is a useful technique for minimizing risk in cross-market betting. This strategy involves placing additional bets to offset potential losses or secure a profit regardless of the final outcome.

By strategically hedging my bets across different markets, I can protect my investments and ensure a more stable betting experience.

Statistical Models

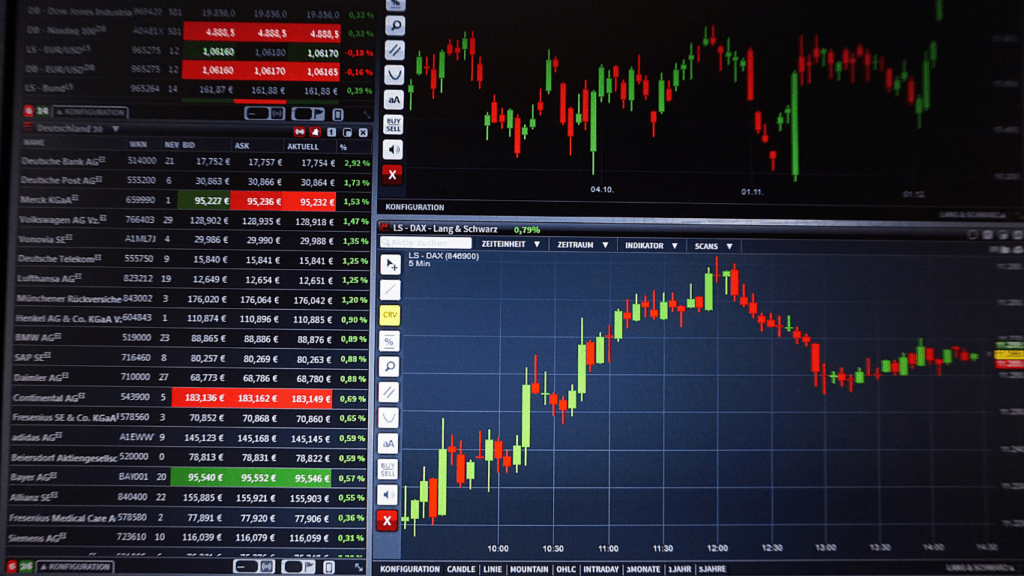

Utilizing statistical models can significantly enhance cross-market betting strategies. By leveraging data analysis and predictive modeling, I can make informed decisions and identify patterns to optimize my betting portfolio.

These models can help me uncover valuable insights, trends, and potential outcomes, giving me a competitive edge in the betting market.

Market Monitoring

Consistent monitoring of multiple markets is essential for successful cross-market betting. By staying informed about changes in odds, market trends, and betting patterns across different platforms, I can adapt my strategies accordingly and capitalize on emerging opportunities.

Regular market monitoring allows me to make well-informed decisions and adjust my bets in real-time to maximize returns.

Implementing Effective Cross-Market Betting

Expanding my betting portfolio across various markets has been integral to maximizing potential returns. By diversifying my bets and exploring multiple markets simultaneously, I’ve discovered undervalued odds and favorable outcomes, ultimately enhancing my overall profitability.

I implement specific strategies for cross-market betting to ensure a competitive edge. Identifying arbitrage opportunities allows me to secure a profit by placing wagers on all potential outcomes across different markets. Additionally, I leverage value betting by capitalizing on odds that underestimate the likelihood of an outcome and utilize hedge betting to minimize risks.

Utilizing statistical models has been crucial in enhancing my decision-making process through data analysis and predictive modeling. Consistent market monitoring enables me to adapt my strategies in real-time, seizing emerging opportunities for greater returns. This proactive approach not only mitigates risks but also maximizes the profitability of my betting endeavors.