Exploring the intricate interplay between geopolitical risks and the wheel betting markets unveils a captivating narrative of uncertainty and opportunity. As I delve into the dynamic landscape where global politics converge with the world of wagering, a compelling story emerges, showcasing how external forces can sway the trajectory of these markets.

With a keen eye on the evolving geopolitical climate, I navigate through the complexities that influence the future outcomes of wheel betting, shedding light on the pivotal role of risk assessment in this realm. In this article, I’ll dissect the nuanced relationship between geopolitical events and their ripple effects on the wheel betting industry, offering insights into the strategies employed by stakeholders to navigate these turbulent waters.

By examining real-world examples and trends, I aim to provide a comprehensive overview of how geopolitical risks serve as both challenges and catalysts for innovation within the wheel betting markets.

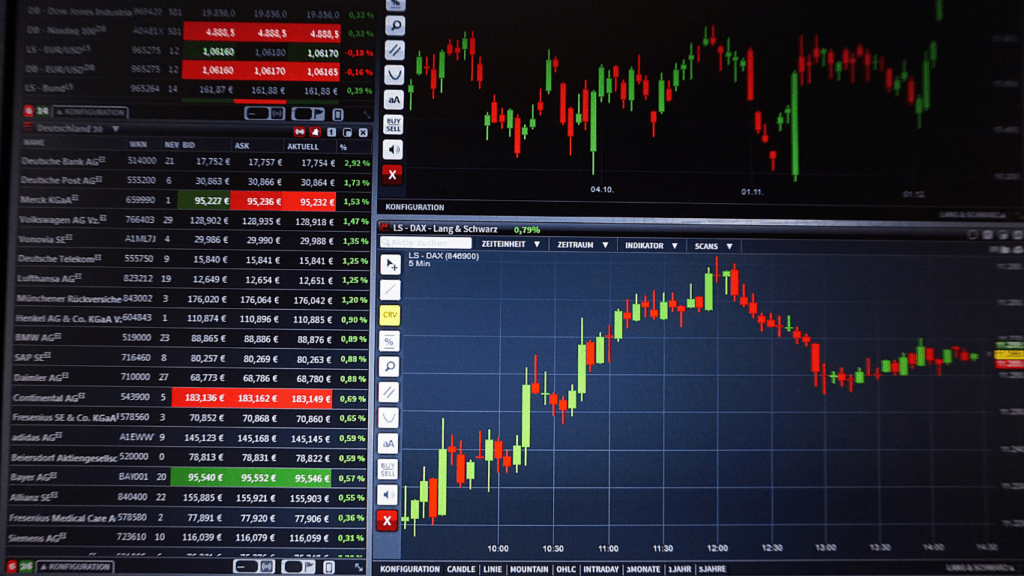

Overview of Geopolitical Risks in Wheel Betting Markets

Understanding the impact of geopolitical risks on wheel betting markets is crucial for stakeholders in this industry. Global political events have the potential to significantly influence the dynamics and outcomes of these wagering environments.

By assessing and addressing these risks effectively, industry players can navigate challenges and capitalize on opportunities for growth and innovation. Analyzing the historical context of geopolitical risks reveals the volatile nature of wheel betting markets.

Factors such as trade disputes, regulatory changes, and international conflicts can create uncertainty and instability within the industry. Stakeholders must stay vigilant and proactive in monitoring these risks to mitigate adverse effects on market performance and profitability.

Real-world examples underscore the tangible effects of geopolitical risks on wheel betting markets. Instances where political tensions led to market disruptions or shifts in consumer behavior highlight the interconnectedness between global events and industry dynamics. Adapting strategies to anticipate and respond to these risks is essential for maintaining a competitive edge in the evolving landscape of wheel betting.

By staying informed and agile in the face of geopolitical uncertainties, stakeholders can not only safeguard their interests but also leverage these challenges as catalysts for innovation and strategic adaptation. The ability to navigate geopolitical risks effectively is a key determinant of success in the wheel betting industry, shaping the future trajectory of market developments and opportunities for sustainable growth.

Impact of Geopolitical Risks on Market Stability

Geopolitical risks play a crucial role in shaping the stability of wheel betting markets. Understanding how global political events can impact these markets is essential for stakeholders to navigate challenges effectively.

By analyzing case studies and strategies, we can gain insights into the significant influence of geopolitical risks on market dynamics.

Case Studies of Geopolitical Risks Disrupting Wheel Betting Markets

- Diplomatic Tensions: In instances where countries engage in diplomatic disputes or conflicts, wheel betting markets can experience disruptions due to regulatory changes and consumer uncertainty. For example, diplomatic conflicts between two nations can lead to sudden policy shifts affecting the market landscape.

- Trade Wars Impact: Trade tensions between major economies can also have a profound impact on wheel betting markets. Tariffs and trade restrictions imposed during trade wars can create uncertainty, influencing consumer spending patterns and market trends.

- Diversification: One effective strategy to mitigate geopolitical risks in wheel betting markets is diversifying operations across different regions. By spreading investments geographically, stakeholders can minimize the impact of localized geopolitical events on their overall market stability.

- Risk Management Frameworks: Developing robust risk management frameworks that account for geopolitical risks is vital for market stability. Stakeholders can implement strategies such as scenario planning and hedging to prepare for and mitigate the impact of geopolitical uncertainties on the industry.

Future Trends in Wheel Betting Markets Amid Geopolitical Risks

Analyzing future trends in wheel betting markets amidst geopolitical risks requires a forward-thinking approach. As the landscape continues to evolve, it’s crucial to anticipate how geopolitical factors will shape the industry moving forward.

- Integration of Risk Assessment Technologies: Leveraging advanced technologies for risk assessment will be paramount in navigating geopolitical uncertainties. By utilizing AI algorithms and data analytics, stakeholders can enhance their ability to forecast potential risks and proactively implement mitigation strategies.

- Adaptation to Regulatory Changes: With geopolitical tensions influencing regulatory environments, market players must remain agile in adapting to shifting requirements. Flexibility in compliance structures and a proactive approach to regulatory updates will be essential for sustained growth in wheel betting markets.

- Global Market Diversification: Diversifying operations across multiple jurisdictions can help mitigate the impact of geopolitical risks on market stability. By spreading investments and resources geographically, stakeholders can reduce their vulnerability to localized disruptions and ensure continued market participation.

- Innovation in Risk Management: Developing innovative risk management frameworks that incorporate scenario planning and hedging strategies will be critical in safeguarding against geopolitical shocks. By fostering a culture of risk awareness and preparedness, industry participants can effectively navigate uncertainties and maintain operational continuity.

- Strategic Partnerships and Alliances: Collaborating with industry peers and forming strategic alliances can provide a collective approach to mitigating geopolitical risks. Sharing insights, resources, and expertise among stakeholders can foster resilience in the face of external pressures and promote stability in wheel betting markets.

By embracing these future trends and adopting proactive measures, stakeholders in the wheel betting industry can position themselves to thrive amidst evolving geopolitical challenges. Staying informed, adaptable, and innovative will be key in leveraging geopolitical risks as opportunities for growth and sustainable development.